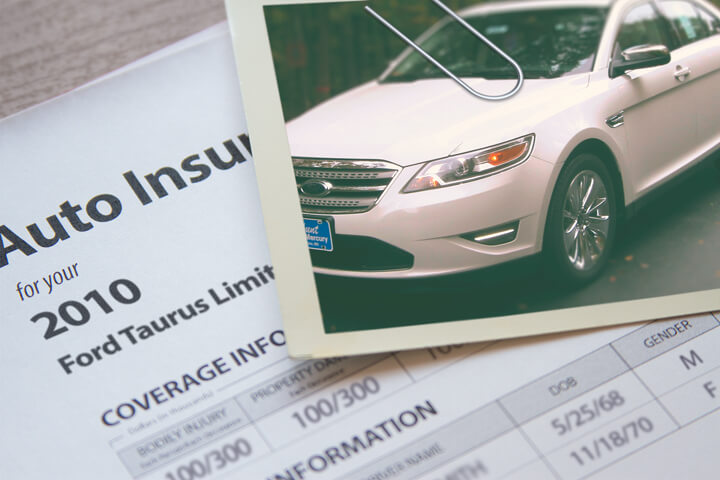

Ford Taurus insurance policy image courtesy of QuoteInspector.com

Remarkably, a study showed that the vast majority of drivers have purchased from the same company for well over three years, and roughly 40% of drivers have never even compared rates from other companies. American drivers can save hundreds of dollars each year, but most tend to underestimate the amount of savings they would get if they replace their high priced policy.

Remarkably, a study showed that the vast majority of drivers have purchased from the same company for well over three years, and roughly 40% of drivers have never even compared rates from other companies. American drivers can save hundreds of dollars each year, but most tend to underestimate the amount of savings they would get if they replace their high priced policy.

The best way to get affordable auto insurance rates is to regularly compare prices from companies who sell insurance in Stockton. You can compare prices by following these steps.

- Try to learn about the coverage provided by your policy and the factors you can control to prevent expensive coverage. Many factors that increase rates such as speeding tickets, careless driving and an unfavorable credit rating can be remedied by making minor driving habit or lifestyle changes. This article provides the details to help prevent high rates and find overlooked discounts.

- Compare price quotes from direct carriers, independent agents, and exclusive agents. Direct and exclusive agents can give quotes from one company like GEICO and Allstate, while independent agents can provide rate quotes for many different companies. Select a company

- Compare the quotes to your current policy premium to determine if you can save on Taurus insurance in Stockton. If you find better rates, make sure there is no coverage gap between policies.

- Provide proper notification to your current company to cancel your current car insurance policy and submit a down payment along with a completed application for the new policy. As soon as you have the new policy, put the new certificate of insurance along with the vehicle's registration papers.

A good tip to remember is to make sure you enter identical coverage information on each price quote and and to get prices from every company you can. This guarantees an accurate price comparison and the best price quote selection.

When comparison shopping, there are several ways to compare rate quotes from local Stockton auto insurance companies. The recommended way to find competitive Ford Taurus insurance rates consists of shopping online.

When comparison shopping, obtaining a wide range of quotes gives you a better chance of getting a lower rate.

The auto insurance companies shown below have been selected to offer quotes in Stockton, CA. If more than one company is shown, it's highly recommended you compare several of them to get the best price comparison.

Detailed insurance information

The coverage table displayed below outlines detailed analysis of prices for Ford Taurus models. Having a good understanding how policy rates are established can help you make smart choices when comparing insurance quotes.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Taurus SE | $476 | $844 | $596 | $36 | $178 | $2,130 | $178 |

| Taurus SEL | $530 | $996 | $596 | $36 | $178 | $2,336 | $195 |

| Taurus SEL AWD | $530 | $996 | $596 | $36 | $178 | $2,336 | $195 |

| Taurus Limited | $530 | $996 | $596 | $36 | $178 | $2,336 | $195 |

| Taurus Limited AWD | $530 | $1146 | $596 | $36 | $178 | $2,486 | $207 |

| Taurus SHO AWD | $586 | $1146 | $596 | $36 | $178 | $2,542 | $212 |

| Get Your Own Custom Quote Go | |||||||

Above prices assume single female driver age 30, no speeding tickets, no at-fault accidents, $100 deductibles, and California minimum liability limits. Discounts applied include claim-free, multi-policy, homeowner, multi-vehicle, and safe-driver. Price information does not factor in specific zip code location which can influence rates noticeably.

Choosing deductibles

When buying auto insurance, a common question is where to set your physical damage deductibles. The comparison tables below can help you visualize the rate fluctuation when you select higher and lower coverage deductibles. The first data set uses a $250 physical damage deductible and the second price chart uses a $500 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Taurus SE | $386 | $576 | $442 | $26 | $132 | $1,587 | $132 |

| Taurus SEL | $430 | $678 | $442 | $26 | $132 | $1,733 | $144 |

| Taurus SEL AWD | $430 | $678 | $442 | $26 | $132 | $1,733 | $144 |

| Taurus Limited | $430 | $678 | $442 | $26 | $132 | $1,733 | $144 |

| Taurus Limited AWD | $430 | $780 | $442 | $26 | $132 | $1,835 | $153 |

| Taurus SHO AWD | $474 | $780 | $442 | $26 | $132 | $1,879 | $157 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Taurus SE | $314 | $464 | $442 | $26 | $132 | $1,378 | $115 |

| Taurus SEL | $348 | $546 | $442 | $26 | $132 | $1,494 | $125 |

| Taurus SEL AWD | $348 | $546 | $442 | $26 | $132 | $1,494 | $125 |

| Taurus Limited | $348 | $546 | $442 | $26 | $132 | $1,494 | $125 |

| Taurus Limited AWD | $348 | $630 | $442 | $26 | $132 | $1,578 | $132 |

| Taurus SHO AWD | $384 | $630 | $442 | $26 | $132 | $1,614 | $135 |

| Get Your Own Custom Quote Go | |||||||

Premium data assumes married male driver age 30, no speeding tickets, no at-fault accidents, and California minimum liability limits. Discounts applied include multi-vehicle, homeowner, claim-free, multi-policy, and safe-driver. Price information does not factor in zip code location which can modify premiums substantially.

We can estimate from the data above that using a $250 deductible costs approximately $20 more each month or $240 annually across all Ford Taurus models than selecting the higher $500 deductible. Due to the fact that you would have to pay $250 more to settle a claim with a $500 deductible as compared to a $250 deductible, if you normally go at a minimum 13 months between claim filings, you would probably be better off by going with a higher deductible.

The illustration below demonstrates how choosing different deductibles and can impact Ford Taurus insurance premiums for each age group. Data assumes a single male driver, full physical damage coverage, and no other discounts are factored in.

Insurance rate increases from tickets or accidents

The illustration below demonstrates how traffic citations and at-fault collisions can affect Ford Taurus yearly insurance costs for each age group. Data assumes a single female driver, comp and collision included, $500 deductibles, and no other discounts are factored in.

Does it make sense to buy full coverage?

The example below illustrates the difference between Ford Taurus insurance costs when comparing full coverage to liability only. The premium estimates are based on no claims or driving citations, $250 deductibles, single status, and no discounts are applied.

When to stop paying for full coverage

There is no clear-cut rule of when to eliminate comp and collision coverage, but there is a general guideline. If the yearly cost of comp and collision coverage is more than around 10% of the replacement cost minus the deductible, the it may be a good time to stop paying for full coverage.

For example, let's pretend your Ford Taurus book value is $6,000 and you have $1,000 physical damage deductibles. If your vehicle is totaled, the most you would receive is $5,000 after paying your policy deductible. If it's costing in excess of $500 annually to have full coverage, then it may be the right time to buy liability only.

There are some circumstances where dropping full coverage is not recommended. If you still owe a portion of the original loan, you are required to maintain full coverage in order to keep the loan. Also, if you cannot afford to purchase a different vehicle in case of an accident, you should maintain full coverage.

Why Informed Drivers Pay Less for Ford Taurus Insurance

Consumers need to have an understanding of some of the elements that go into determining car insurance rates. When consumers understand what influences your rates, this helps enable you to make changes that could result in lower rates. Many different elements are used when you get your auto insurance bill. A few of the factors are predictable such as traffic violations, but other criteria are more obscure such as your marital status or your vehicle rating.

Shown below are a few of the "ingredients" used by companies to determine rates.

- Maintain car insurance coverage - Driving without insurance is against the law and you may have a hard time finding new coverage because you let your insurance coverage expire. Not only will you pay more, failure to provide proof of insurance can result in a revoked license or a big fine. You may need to submit proof of financial responsibility or a SR-22 with the California department of motor vehicles.

- Higher premiums for stressful employers - Occupations such as real estate brokers, business owners, and accountants generally have higher rates than average attributed to high stress levels and lengthy work days. Conversely, careers like actors, engineers and retirees pay the least.

- Cheaper car insurance rates for being claim-free - If you are a frequent claim filer, you should expect higher rates. Auto insurance companies in California award most affordable rates to insureds who are claim-free. Auto insurance is designed for major claims that would cause financial hardship.

- Married drivers pay lower premiums - Walking down the aisle helps lower the price compared to being single. Having a significant other may mean you are less irresponsible and statistics show being married results in fewer claims.

- Put fewer miles on your vehicle - The higher the mileage driven each year the more you'll pay to insure it. Many insurance companies charge to insure your cars determined by how the vehicle is used. Autos that do not get driven very much receive better premium rates than those that get driven frequently. Having the wrong rating on your Taurus may be costing you. It's a good idea to make sure your car insurance policy is rated on annual mileage.

-

Insurance loss data for Ford Taurus vehicles - Companies use historical loss data to calculate a price that will offset any claims. Vehicles that tend to have higher losses will have higher premium rates. The information below illustrates the compiled insurance loss statistics for Ford Taurus vehicles.

For each policy coverage, the statistical loss for all vehicles, regardless of make or model, is set at 100. Percentage values below 100 represent a good loss history, while values that are 100 or greater indicate higher probability of having a loss or tendency to have larger claims.

Ford Taurus Insurance Claim Statistics Vehicle Make and Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Ford Taurus 2WD 109 88 134 115 115 101 Ford Taurus 4WD 120 78 141 124 Ford Taurus SHO 4WD 143 96 185 84 103 BETTERAVERAGEWORSEEmpty fields indicate not enough data collected

Statistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Three good reasons to insure your Taurus

Despite the high cost, insuring your vehicle is required in California but it also protects you in many ways.

- Almost all states have minimum liability requirements which means the state requires a specific minimum amount of liability insurance if you drive a vehicle. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If you have a loan on your Taurus, it's most likely the lender will require you to have insurance to ensure they get paid if you total the vehicle. If coverage lapses or is canceled, the lender may have to buy a policy to insure your Ford at a much higher rate and force you to reimburse them a much higher amount than you were paying before.

- Insurance protects both your car and your assets. It will also reimburse you for all forms of medical expenses for you, your passengers, and anyone else injured in an accident. As part of your policy, liability insurance also covers all legal expenses up to the policy limit if anyone sues you for causing an accident. If mother nature or an accident damages your car, comprehensive and/or collision insurance will pay all costs to repair after the deductible has been paid.

The benefits of insuring your Taurus definitely exceed the price paid, especially when you need to use it. According to a 2015 survey, the average American driver overpays as much as $855 a year so it's very important to do a rate comparison every year to ensure rates are competitive.