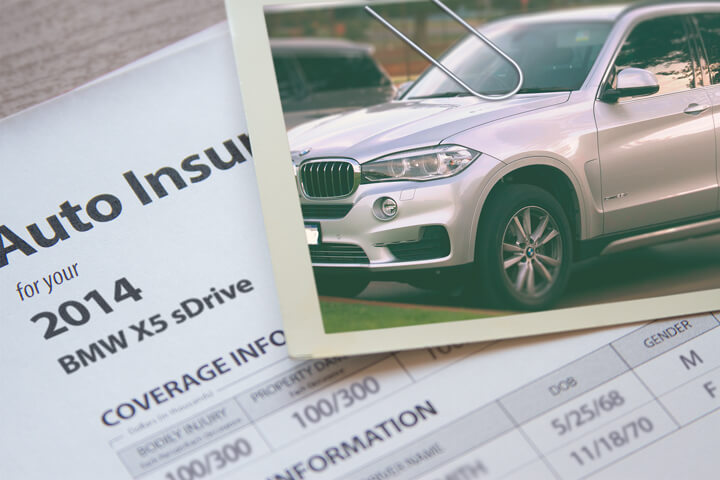

BMW X5 insurance rates image courtesy of QuoteInspector.com

Inconceivable but true, most car insurance policyholders have purchased from the same company for more than four years, and virtually 40% of consumers have never compared rates to find lower-cost insurance. Stockton drivers can cut their rates by about 35% a year by just shopping around, but they mistakenly think it's difficult to go online and compare rates.

Inconceivable but true, most car insurance policyholders have purchased from the same company for more than four years, and virtually 40% of consumers have never compared rates to find lower-cost insurance. Stockton drivers can cut their rates by about 35% a year by just shopping around, but they mistakenly think it's difficult to go online and compare rates.

The most effective way to get the cheapest BMW X5 insurance in Stockton is to make a habit of comparing prices annually from providers in California. Rate comparisons can be done by following these guidelines.

First, get a basic knowledge of car insurance and the factors you can control to drop your rates. Many rating factors that result in higher rates like distracted driving and an imperfect credit score can be amended by making small lifestyle or driving habit changes. Continue reading for additional tips to get low prices and get additional discounts that may be available.

Second, compare prices from exclusive agents, independent agents, and direct providers. Exclusive and direct companies can give quotes from a single company like GEICO or State Farm, while independent agencies can quote rates from many different companies.

Third, compare the new rates to the premium of your current policy to determine if you can save on X5 insurance in Stockton. If you find better rates, make sure there is no coverage gap between policies.

Fourth, provide written notification to your current company of your decision to cancel the current policy and submit a completed application and payment for your new coverage. Immediately put the new certificate of insurance somewhere easily accessible.

A tip to remember is to compare the same amount of coverage on each price quote and and to compare as many different companies as possible. Doing this helps ensure a level playing field and the best price selection.

If you are insured now or just want cheaper coverage, use these techniques to save money and still get good coverage. Buying affordable auto insurance in Stockton is quite easy if you know the best way to do it. Drivers just need to understand the quickest way to get comparison quotes online.

Finding low cost insurance rates isn't really that difficult. All you need to do is spend a few minutes comparing rate quotes to find out which insurance company has cheaper Stockton auto insurance quotes.

Comparing free rate quotes online is easy and it, makes it obsolete to make phone calls or go to different agent offices. Shopping for insurance online eliminates the need for an insurance agent unless you want the trained advice of a licensed agent. However, consumers can get prices online but have your policy serviced through an agent.

The following companies offer free quotes in Stockton, CA. If multiple companies are shown, it's highly recommended you visit two to three different companies in order to get a fair rate comparison.

Auto insurance in California serves several purposes

Despite the potentially high cost of BMW X5 insurance, paying for auto insurance serves several important purposes.

- Just about all states have mandatory insurance requirements which means you are required to carry a specific minimum amount of liability insurance coverage if you don't want to risk a ticket. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If your vehicle has a lienholder, most lenders will force you to buy insurance to guarantee their interest in the vehicle. If you let the policy lapse, the lender will be forced to insure your BMW at a much higher premium rate and require you to fork over the higher price.

- Insurance safeguards both your assets and your BMW. It will also reimburse you for many types of medical costs incurred in an accident. Liability insurance also covers legal expenses if you cause an accident and are sued. If you have damage to your BMW as the result of the weather or an accident, comprehensive and/or collision insurance will pay to have it repaired.

The benefits of insuring your X5 definitely exceed the price paid, especially if you ever need it. According to a recent study, the average American driver is overpaying over $830 a year so you should quote and compare rates every year to ensure rates are competitive.

Car insurance analysis for a BMW X5

The data table shown next outlines different rate quotes for BMW X5 models. Having a better understanding of how rate quotes are established can help you make informed coverage decisions.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| X5 3.0I AWD | $258 | $418 | $450 | $26 | $134 | $1,286 | $107 |

| X5 3.5D AWD | $284 | $482 | $450 | $26 | $134 | $1,376 | $115 |

| X5 4.8I AWD | $284 | $482 | $450 | $26 | $134 | $1,376 | $115 |

| X5 M AWD | $336 | $608 | $450 | $26 | $134 | $1,554 | $130 |

| Get Your Own Custom Quote Go | |||||||

Premium data assumes married female driver age 30, no speeding tickets, no at-fault accidents, $1000 deductibles, and California minimum liability limits. Discounts applied include multi-policy, safe-driver, claim-free, multi-vehicle, and homeowner. Rate quotes do not factor in vehicle garaging location which can alter premiums significantly.

Choosing deductibles

One frequently asked question is how low should you set your deductibles. The comparison tables below may help you to understand the difference in cost when you select higher and lower physical damage coverage deductibles. The first set of prices uses a $250 physical damage coverage deductible and the second set of rates uses a $1,000 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| X5 3.0I AWD | $430 | $678 | $442 | $26 | $132 | $1,733 | $144 |

| X5 3.5D AWD | $474 | $780 | $442 | $26 | $132 | $1,879 | $157 |

| X5 4.8I AWD | $474 | $780 | $442 | $26 | $132 | $1,879 | $157 |

| X5 M AWD | $562 | $986 | $442 | $26 | $132 | $2,173 | $181 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| X5 3.0I AWD | $266 | $426 | $442 | $26 | $132 | $1,292 | $108 |

| X5 3.5D AWD | $292 | $490 | $442 | $26 | $132 | $1,382 | $115 |

| X5 4.8I AWD | $292 | $490 | $442 | $26 | $132 | $1,382 | $115 |

| X5 M AWD | $346 | $620 | $442 | $26 | $132 | $1,566 | $131 |

| Get Your Own Custom Quote Go | |||||||

Data assumes married male driver age 30, no speeding tickets, no at-fault accidents, and California minimum liability limits. Discounts applied include multi-vehicle, multi-policy, safe-driver, homeowner, and claim-free. Estimates do not factor in specific garaging location which can lower or raise coverage prices significantly.

Based on the figures above, using a $250 deductible will cost you about $43 more each month or $516 every year than choosing the higher $1,000 deductible. Because you would be required to pay $750 more if you file a claim with a $1,000 deductible as compared to a $250 deductible, if you have at a minimum 17 months between claim filings, you would save money if you elect the higher deductible.

Calculation for determining deductible levels

| Average monthly premium for $250 deductibles: | $160 |

| Average monthly premium for $1,000 deductibles (subtract): | - $117 |

| Monthly savings from raising deductible: | $43 |

| Difference between deductibles ($1,000 - $250): | $750 |

| Divide difference by monthly savings: | $750 / $43 |

| Number of months required between physical damage coverage claims in order to save money by choosing the higher deductible | 17 months |

One thing to note is that higher deductibles means you will have to pay more out-of-pocket when you have a comprehensive or collision claim. You need to have some extra savings in order to pay the higher deductible.

The illustration below illustrates how your choice of deductibles and can increase or decrease BMW X5 insurance rates for each age group. The data assumes a married female driver, full coverage, and no discounts are applied to the premium.

Men versus women drivers and insurance cost

The illustration below visualizes the comparison of BMW X5 yearly insurance costs for male and female drivers. The prices are based on no accidents, no driving violations, comp and collision included, $100 deductibles, drivers are not married, and no discounts are factored in.

Lower your insurance rates with discounts

Some providers don't always list all discounts in an easy-to-find place, so we took the time to find both the well known and also the more inconspicuous ways to save on insurance.

- Driver's Education for Students - Require your teen driver to successfully complete driver's ed class in school or through a local driver safety program.

- Stockton Homeowners Pay Less - Simply owning a home may earn you a small savings because it requires personal responsibility.

- Paper-free Discount - A handful of companies will give you a small discount for buying your policy digitally online.

- Bundle and Save - If you combine your auto and homeowners policies with one insurance company you could get a discount of as much as 10 to 15 percent.

- Multiple Cars - Buying a policy with multiple cars on one policy can reduce rates for all insured vehicles.

- Life Insurance - Insurance companies who offer life insurance give lower insurance rates if you buy life insurance.

- Low Mileage - Low mileage vehicles can qualify you for lower prices due to less chance of an accident.

We need to note that some credits don't apply to the overall cost of the policy. The majority will only reduce the price of certain insurance coverages like physical damage coverage or medical payments. Despite the fact that it seems like you could get a free insurance policy, you aren't that lucky.

The example below illustrates the comparison of BMW X5 insurance costs with and without discounts applied to the premium. The premium estimates are based on a female driver, a clean driving record, no claims, California state minimum liability limits, full coverage, and $250 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with marriage, homeowner, multi-car, multi-policy, claim-free, and safe-driver discounts applied.

The best insurance companies and a partial list of their discounts include:

- State Farm offers discounts including driver's education, Steer Clear safe driver discount, anti-theft, safe vehicle, multiple policy, student away at school, and multiple autos.

- Liberty Mutual offers discounts for good student, preferred payment discount, newly married, teen driver discount, and new vehicle discount.

- American Family may offer discounts for mySafetyValet, air bags, bundled insurance, accident-free, good driver, and early bird.

- Progressive has savings for homeowner, online signing, continuous coverage, online quote discount, good student, and multi-policy.

- Farmers Insurance discounts include business and professional, distant student, pay in full, electronic funds transfer, teen driver, and homeowner.

- Auto-Owners Insurance has discounts for anti-theft, group or association, student away at school, multiple vehicles, and paperless.

- SAFECO may have discounts that include accident prevention training, homeowner, anti-theft, safe driver, teen safety rewards, and drive less.

When getting free Stockton auto insurance quotes, it's a good idea to each company to give you their best rates. All car insurance discounts might not be offered on policies everywhere. If you would like to see a list of providers who offer online BMW X5 insurance quotes in Stockton, click this link.

Different people need different insurance coverages

When it comes to choosing the best insurance coverage, there is no cookie cutter policy. Your financial needs are unique and a cookie cutter policy won't apply. These are some specific questions might help in determining whether you may require specific advice.

These are some specific questions might help in determining whether you may require specific advice.

- How much will a speeding ticket raise my rates?

- At what point should I drop full coverage?

- Am I better off with higher deductibles on my BMW X5?

- What are good deductibles for a BMW X5?

- How much can I save by bundling my policies?

- Can I still get insurance after a DUI?

- Does low annual mileage earn a discount?

- Do I need more liability coverage?

- Why am I required to buy high-risk coverage?

- When would I need additional glass coverage?

If you don't know the answers to these questions, you might consider talking to a licensed agent. To find an agent in your area, fill out this quick form or you can also visit this page to select a carrier It's fast, free and may give you better protection.