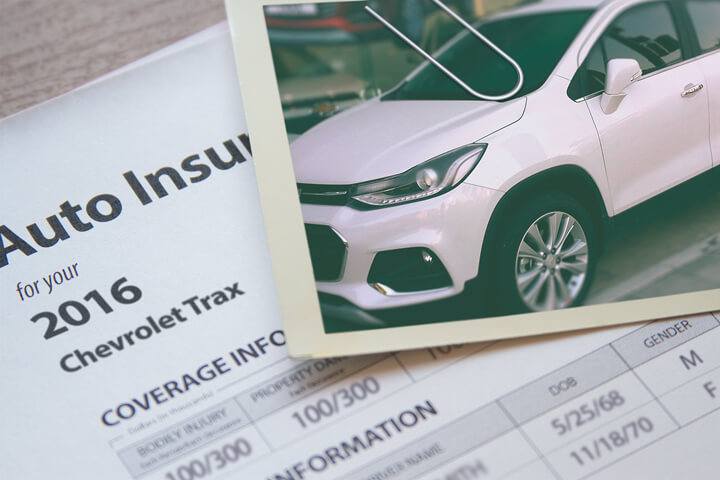

Chevy Trax insurance image courtesy of QuoteInspector.com

It's easy to assume that car insurance companies don't want you to compare rates. Insureds who compare rates annually are very likely to move their business because there is a great chance of finding a lower rate. A recent study showed that consumers who routinely compared rates saved as much as $865 a year compared to those who never compared rates.

If finding low prices for Chevy Trax insurance is the reason you're reading this, then understanding the best way to shop and compare auto insurance can help you succeed in finding affordable rates.

The best way we recommend to get budget car insurance rates in Stockton is to compare prices at least once a year from companies who provide auto insurance in California. Drivers can shop around by following these steps.

The best way we recommend to get budget car insurance rates in Stockton is to compare prices at least once a year from companies who provide auto insurance in California. Drivers can shop around by following these steps.

First, try to comprehend how companies set rates and the measures you can take to prevent expensive coverage. Many policy risk factors that are responsible for high rates such as your driving record and poor credit can be eliminated by paying attention to minor details. This article provides more ideas to help find cheaper rates and earn larger discounts.

Second, request rate estimates from direct, independent, and exclusive agents. Direct companies and exclusive agencies can only give rate quotes from a single company like Progressive or Allstate, while agents who are independent can provide rate quotes from multiple companies.

Third, compare the new rate quotes to your current policy to see if you can save by switching companies. If you find a better price and change companies, make sure coverage does not lapse between policies.

Fourth, give notification to your current company to cancel your existing policy. Submit the signed application along with the required initial payment to your new company or agent. Don't forget to safely store the proof of insurance paperwork with your registration paperwork.

The key thing to remember is to compare identical coverage information on each price quote and and to get rate quotes from as many carriers as you can. This guarantees an accurate price comparison and a complete rate analysis.

This information will introduce you to the best ways to compare prices and how you can save the most money. If you are already insured, you will surely be able to find the best rates using this information. But California car owners can benefit from knowing how insurance companies calculate your policy premium and apply this information to your search.

When shopping for Chevy Trax insurance in Stockton there are multiple ways of comparing rates from all the different companies. One of the best ways to comparison shop is to use the internet to compare rates.

Just keep in mind that comparing more rates from different companies will improve the odds of getting more affordable rates.

The following companies provide comparison quotes in Stockton, CA. If multiple companies are listed, it's highly recommended you get rates from several of them in order to get a fair rate comparison.

Three reasons to not skimp on auto insurance

Despite the fact that auto insurance is not cheap in Stockton, buying auto insurance is a good idea for several reasons.

- Just about all states have minimum mandated liability insurance limits which means state laws require specific minimum amounts of liability insurance in order to be legal. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If you bought your Chevy Trax with a loan, it's guaranteed your bank will stipulate that you buy full coverage to guarantee loan repayment. If the policy lapses, the lender will be forced to insure your Chevy at a significantly higher premium and force you to reimburse them much more than you were paying before.

- Insurance protects both your Chevy Trax and your personal assets. It will also provide coverage for many types of medical costs for you, your passengers, and anyone else injured in an accident. Liability insurance will also pay to defend you if anyone sues you for causing an accident. If your vehicle suffers damage from an accident or hail, your auto insurance policy will pay all costs to repair after the deductible has been paid.

The benefits of buying enough insurance outweigh the cost, particularly if you ever have a claim. Today the average American driver overpays more than $810 a year so you should quote rates at every policy renewal to ensure rates are competitive.

Smart Choices Result in Lower Insurance Costs

Many different elements are part of the calculation when you get your auto insurance bill. Some are pretty understandable like your driving record, but other factors are more transparent such as your credit history and annual miles driven.

- Cheaper to insure women? - Over the last 30 years, statistics show women tend to be less risk to insure than men. However, this does not mean men are WORSE drivers than women. They both are in at-fault accidents in similar percentages, but males have accidents that have higher claims. Men also tend to have more aggressive citations such as DWI and reckless driving.

- Your location is important - Living in smaller towns and rural areas of the country can be a good thing if you are looking for the lowest rates. Lower population means fewer accidents. People in densely populated areas have to deal with more auto accidents and a longer drive to work. More time behind the wheel can result in more accidents.

- Cars with good safety ratings save money - Vehicles with good safety scores tend to have lower insurance rates. Highly rated vehicles reduce occupant injuries and fewer injuries means less claims paid which can mean better rates for you. If your Chevy is rated at a minimum an "acceptable" rating on the Insurance Institute for Highway Safety website or four stars on the National Highway Traffic Safety Administration website it may cost less to insure.

- Driver age impacts costs - Older insureds are more responsible, tend to file fewer claims, and get fewer tickets. Youthful drivers are statistically shown to be inattentive and easily distracted when driving with friends and because of this, their auto insurance rates are much higher.

- Cheaper rates for prior coverage - Driving without insurance is not a good idea and you may have a hard time finding new coverage because you let your coverage cancel without a new policy in place. Not only will you pay higher rates, not being able to provide proof of insurance could result in a steep fine or even jail time.

- Marriage reduces risk - Getting married may save some money on your auto insurance bill. Having a spouse means you're more mature than a single person and it's statistically proven that being married results in fewer claims.

- Car insurance liability coverage limits - The liability section of your policy will provide protection when you are found liable for damages from an accident. Your policy's liability insurance provides legal defense starting from day one. Liability insurance is quite affordable compared to physical damage coverage, so do not skimp.

- Car plus home equals more savings - Most insurance companies provide lower prices to insureds that buy multiple policies, otherwise known as a multi-policy discount. Even with this discount, you may still want to compare other company rates to confirm you are receiving the best rates possible.

-

Chevy Trax insurance loss statistics - Companies use statistical claims data in order to profitably underwrite each model. Vehicles that the statistics show to have increased losses will be charged more to insure.

The data below shows the collected loss data for Chevy Trax vehicles. For each type of coverage, the statistical loss for all vehicles, without regard to make or model, is a value of 100. Numbers under 100 mean the vehicle has better than average losses, while numbers that are greater than 100 indicate more frequent losses or an increased chance of larger losses than average.

Chevrolet Trax Insurance Claim Statistics Vehicle Make and Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Chevrolet Trax 4dr 2WD 79 Chevrolet Trax 4dr 4WD 81 BETTERAVERAGEWORSEEmpty fields indicate not enough data collected

Statistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Stockton auto insurance companies

Selecting a highly-rated auto insurance company can be a challenge considering how many companies sell insurance in California. The ranking data shown next may help you pick which car insurance companies to look at comparing rates from.

Top 10 Stockton Car Insurance Companies Ranked by Value

- USAA

- American Family

- The Hartford

- AAA of Southern California

- Titan Insurance

- The General

- AAA Insurance

- State Farm

- Mercury Insurance

- Nationwide

Persistence will pay off

You just read many ways to get a better price on Chevy Trax insurance in Stockton. The key concept to understand is the more price quotes you have, the better your comparison will be. Consumers may even find the biggest savings come from a lesser-known regional company.

A few companies may not have internet price quotes and most of the time these smaller companies only sell through local independent agents. Cheaper insurance in Stockton is definitely available online and with local Stockton insurance agents, and you should compare price quotes from both to have the best rate selection.

Drivers leave their current company for a variety of reasons including not issuing a premium refund, high prices, delays in paying claims or high rates after DUI convictions. Whatever your reason, choosing a new company can be easy and end up saving you some money.

Additional insurance information is located at these links:

- Auto Insurance Facts and Statistics (Insurance Information Institute)

- Safety Features for Your New Car (State Farm)

- Tools for Teen Driving Safety (State Farm)