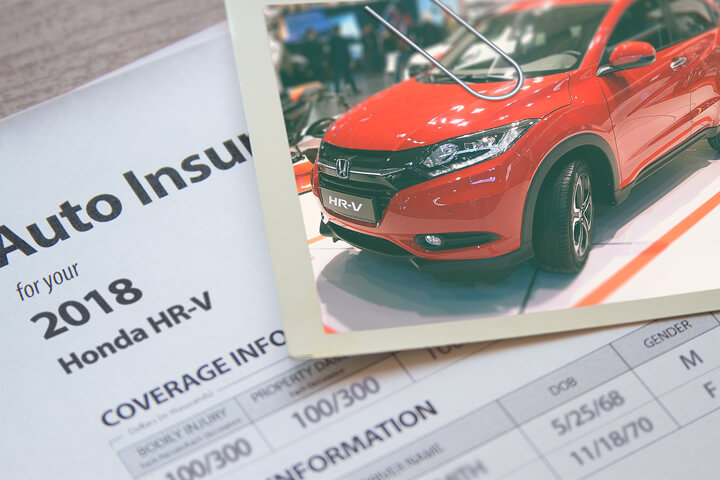

Honda HR-V insurance cost image courtesy of QuoteInspector.com

Shocking but true, a large majority of car insurance policyholders have been with the same company for well over three years, and just under half have never shopped around. California drivers could pocket approximately 35% a year, but they just feel it's too hard to do a rate comparison.

Shocking but true, a large majority of car insurance policyholders have been with the same company for well over three years, and just under half have never shopped around. California drivers could pocket approximately 35% a year, but they just feel it's too hard to do a rate comparison.

The best way we recommend to find cheaper quotes for Honda HR-V insurance is to compare prices once a year from insurance carriers in Stockton.

- Get a basic knowledge of how companies price auto insurance and the steps you can take to prevent high rates. Many things that increase rates such as distracted driving and a low credit rating can be controlled by improving your driving habits or financial responsibility.

- Obtain price quotes from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can only provide price estimates from a single company like GEICO or State Farm, while agents who are independent can quote rates from many different companies.

- Compare the new quotes to the price on your current policy and see if there is a cheaper rate in Stockton. If you find a lower rate quote and buy the policy, make sure there is no coverage gap between policies.

- Provide notification to your current company of your intention to cancel your current car insurance policy. Submit a completed policy application and payment to your new agent or company. As soon as you have the new policy, keep your new certificate verifying proof of insurance in an easily accessible location in your vehicle.

The key thing to remember is to try to compare the same coverage limits and deductibles on each quote and to quote with as many different insurance providers as possible. Doing this guarantees a level playing field and a complete rate analysis.

Six Things That Affect Your Insurance Rates

When buying auto insurance it's important to understand some of the factors that help determine your auto insurance rates. If you have some idea of what positively or negatively impacts your premiums, this enables you to make decisions that may reward you with lower auto insurance prices. Many things are used when you quote your car insurance policy. Some are pretty understandable such as traffic violations, although others are not quite as obvious such as whether you are married or your commute time.

Cars with good safety ratings mean better auto insurance rates - Safer cars get lower rates. Safer cars help reduce the chance of injuries in an accident and fewer serious injuries means less money paid by your insurance company and more competitive rates for policyholders.

How credit rating affects auto insurance prices - Having a bad credit score will be a significant factor in calculating your auto insurance rates. Insureds with high credit scores tend to file fewer claims as compared to drivers with worse credit. If your credit history is low, you could pay less to insure your Honda HR-V if you improve your credit rating.

Save money by having multiple policies - Most major companies provide lower prices for people that have more than one policy, otherwise known as a multi-policy discount. Even with this discount, it's always a smart idea to comparison shop to help ensure you have the lowest rates. You may still find better rates even if you insure with multiple companies

Insurance rates are higher for high performance vehicles - The type of vehicle you need to insure makes a big difference in your auto insurance rates. The most favorable rates will normally be found when insuring low performance passenger models, but many other things help determine your insurance rates.

More miles equals more premium - The higher the miles on your Honda in a year's time the higher the price you pay to insure it. A lot of insurance companies apply a rate based upon how you use the vehicle. Vehicles that have low annual miles receive better premium rates as compared to vehicles used primarily for driving to work. Having the wrong rating on your HR-V may be costing you. It's a smart idea to ensure your vehicle rating reflects the right rating data, because it can save money.

Good drivers pay lower premiums - How you drive has a big impact on rates. Just one speeding ticket or other violation may cause rates to rise substantially. Careful drivers pay less for auto insurance than bad drivers. People who have dangerous citations like DUI, reckless driving or excessive speeding may find that they have to to maintain a SR-22 with the DMV in their state in order to legally drive.

Get cheaper rates by receiving discounts

Car insurance can cost a lot, but there could be significant discounts to help offset the cost. Most are applied when you get a quote, but a few need to be manually applied prior to receiving the credit.

- Discount for Life Insurance - Select insurance carriers reward you with a break if you buy a life insurance policy as well.

- Early Payment Discounts - If you pay your bill all at once instead of monthly or quarterly installments you may have a lower total premium amount.

- Accident Free - Drivers with accident-free driving histories pay much less compared to drivers who are more careless.

- Senior Citizen Rates - If you qualify as a senior citizen, you can get a small decrease in premiums.

- Air Bags and Passive Restraints - Factory options such as air bags or motorized seat belts can get savings up to 30%.

- Government Employees - Being employed by or retired from a federal job could provide a small rate reduction with some insurance companies.

- Theft Prevention System - Cars equipped with anti-theft or alarm systems can help prevent theft so companies will give you a small discount.

- Resident Student - Youth drivers who live away from home at college and don't have a car may be able to be covered for less.

As a footnote on discounts, many deductions do not apply to the entire cost. Most only apply to the cost of specific coverages such as liability and collision coverage. Even though the math looks like you could get a free insurance policy, you're out of luck.

To locate insurers that offer many of these discounts in California, follow this link.

Quote often and quote early

Cheaper Honda HR-V insurance in Stockton can be bought on the web and with local Stockton insurance agents, and you should be comparing both to have the best rate selection. Some companies do not provide rate quotes online and most of the time these small insurance companies provide coverage only through independent agents.

People leave their current company for any number of reasons including delays in responding to claim requests, denial of a claim, high rates after DUI convictions or even lack of trust in their agent. It doesn't matter what your reason, finding a new company can be easy and end up saving you some money.

As you prepare to switch companies, it's a bad idea to buy less coverage just to save a little money. In many instances, drivers have reduced collision coverage to discover at claim time they didn't purchase enough coverage. The proper strategy is to find the BEST coverage at the best price, not the least amount of coverage.

Helpful information

- Child Safety Seats (Insurance Information Institute)

- Who Has Affordable Car Insurance Quotes for Low Mileage Drivers in Stockton? (FAQ)

- Who Has Cheap Stockton Car Insurance Quotes for Hybrid Vehicles? (FAQ)

- If I File a Claim will My Insurance Go Up? (Insurance Information Institute)

- Auto Insurance Basics (Insurance Information Institute)

- When is the Right Time to Switch Car Insurance Companies? (Allstate)