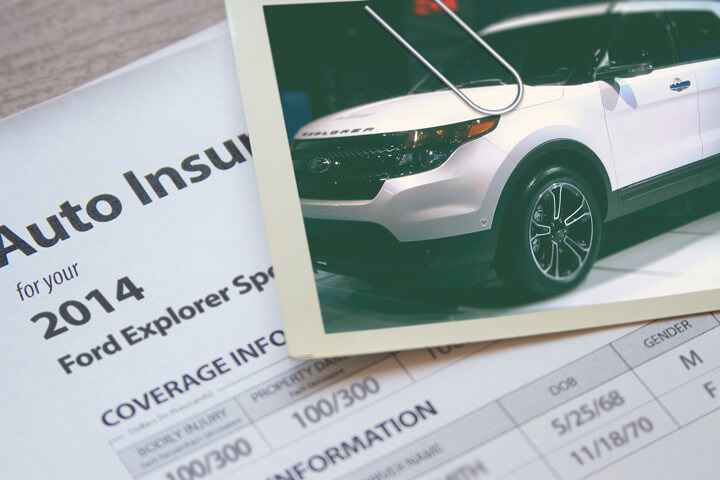

Ford Explorer insurance image courtesy of QuoteInspector.com

Smart shoppers know that car insurance companies don't want you to look at other companies. People who shop around for better prices are very likely to buy a new policy because there is a good probability of finding lower prices. A recent survey revealed that consumers who routinely compared rates saved about $3,400 over four years compared to people who never shopped around for better prices.

If finding the lowest rates on insurance in Stockton is your goal, then having some insight into how to shop and compare insurance can save time and make the process easier.

It takes a few minutes, but the best way to find lower priced auto insurance rates in Stockton is to annually compare prices from insurance carriers who can sell car insurance in California. Price quotes can be compared by completing these steps.

It takes a few minutes, but the best way to find lower priced auto insurance rates in Stockton is to annually compare prices from insurance carriers who can sell car insurance in California. Price quotes can be compared by completing these steps.

- Spend some time learning about the coverage provided by your policy and the things you can control to keep rates in check. Many rating criteria that drive up the price like tickets, at-fault accidents, and a negative credit score can be rectified by being financially responsible and driving safely. This article provides instructions to help reduce premium rates and find overlooked discounts.

- Compare prices from direct, independent, and exclusive agents. Direct and exclusive agents can give quotes from a single company like Progressive or Farmers Insurance, while independent agencies can provide price quotes from multiple sources. Select a company

- Compare the new rates to your current policy to determine if you can save on Explorer Sport Trac insurance in Stockton. If you find a lower rate quote, make sure the effective date of the new policy is the same as the expiration date of the old one.

- Provide proper notification to your current company to cancel your current auto insurance policy. Submit a down payment along with a completed application for your new policy. Be sure to keep the new certificate verifying coverage above your visor, in the console, or in the glove compartment.

A good tip to remember is to compare the same amount of coverage on each quote request and and to get price quotes from as many companies as possible. Doing this provides a fair rate comparison and a better comparison of the market.

Locating the best rates in Stockton can really be easy if you know what you're doing. If you have coverage now or just want cheaper coverage, you will benefit by learning to buy cheaper insurance without having to cut coverage. You just have to know how to quote multiple rates online.

Finding Ford Explorer Sport Trac insurance in Stockton, CA

Getting more affordable car insurance pricing is actually easier than you may think. Drivers just need to invest a little time comparing price quotes to discover which company has low cost Stockton auto insurance quotes.

The companies shown below offer free rate quotes in California. If multiple providers are shown, we suggest you compare several of them in order to find the cheapest rates.

Get cheaper Ford Explorer Sport Trac insurance in Stockton with discounts

Some providers do not list all possible discounts in an easy-to-find place, so the next list breaks down both well-publicized and the harder-to-find credits available to lower your premiums when you buy Stockton auto insurance online.

- Home Ownership Discount - Being a homeowner can get you a discount since owning and maintaining a home requires personal responsibility.

- ABS Braking Discount - Cars, trucks, and SUVs that have steering control and anti-lock brakes can reduce accidents and the ABS can save up to 10%.

- Accident Forgiveness - Not necessarily a discount, but some companies like Allstate, Progressive, and GEICO may permit one accident without getting socked with a rate hike if you are claim-free for a set time period.

- Theft Prevention System - Vehicles that have factory alarm systems and tracking devices are stolen less frequently and that can save you a little bit as well.

- Safety Course Discount - Completing a defensive driving course may get you a small discount depending on where you live.

As is typical with insurance, most credits do not apply to the overall cost of the policy. Some only apply to the price of certain insurance coverages like comp or med pay. So even though it sounds like you would end up receiving a 100% discount, companies wouldn't make money that way.

The example below shows the difference between Ford Explorer Sport Trac insurance costs with and without discounts applied to the rates. The costs are based on a female driver, no driving violations, no at-fault accidents, California state minimum liability limits, comp and collision included, and $250 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with multi-policy, homeowner, safe-driver, claim-free, multi-car, and marriage discounts applied.

If you would like to view companies that can offer you the previously mentioned discounts in California, click here.

Rates and statistics

The rate table below showcases detailed analysis of coverage prices for Ford Explorer Sport Trac models. Having a good grasp of how insurance policy rates are determined is important for you to make informed decisions when comparing rate quotes.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Explorer Sport Trac XLT 2WD | $178 | $292 | $450 | $26 | $134 | $1,080 | $90 |

| Explorer Sport Trac Limited 2WD | $204 | $292 | $450 | $26 | $134 | $1,106 | $92 |

| Explorer Sport Trac XLT 4WD | $204 | $292 | $450 | $26 | $134 | $1,106 | $92 |

| Explorer Sport Trac Limited 4WD | $230 | $354 | $450 | $26 | $134 | $1,194 | $100 |

| Explorer Sport Trac Limited AWD | $230 | $354 | $450 | $26 | $134 | $1,194 | $100 |

| Get Your Own Custom Quote Go | |||||||

Table data represents married female driver age 30, no speeding tickets, no at-fault accidents, $1000 deductibles, and California minimum liability limits. Discounts applied include safe-driver, claim-free, homeowner, multi-policy, and multi-vehicle. Rate information does not factor in specific Stockton garaging location which can affect price quotes significantly.

How accidents and tickets impact rates in Stockton

The diagram below shows how speeding tickets and at-fault collisions can influence Ford Explorer Sport Trac car insurance costs for each age group. Data assumes a single female driver, comprehensive and collision coverage, $500 deductibles, and no discounts are applied to the premium.

Ford Explorer Sport Trac insurance costs by gender and age

The information below illustrates the difference between Ford Explorer Sport Trac car insurance costs for male and female drivers. The information is based on no claims or driving citations, full physical damage coverage, $100 deductibles, single status, and no policy discounts are applied.

Ford Explorer Sport Trac liability rates compared to full coverage

The chart below visualizes the comparison of Ford Explorer Sport Trac insurance premiums with full physical damage coverage and with liability coverage only. The data assumes a clean driving record, no at-fault accidents, $250 deductibles, drivers are not married, and no discounts are applied to the premium.

When to drop full coverage

There is no exact formula of when to stop paying for full coverage on your policy, but there is a general school of thought. If the annual cost of your full coverage insurance is 10% or more of any settlement you would receive from your insurance company, then you may want to consider only buying liability coverage.

For example, let's assume your Ford Explorer Sport Trac replacement cost is $5,000 and you have $1,000 deductibles. If your vehicle is destroyed, the most your company will settle for is $4,000 after paying your policy deductible. If you are paying over $400 a year for your policy with full coverage, then it could be time to drop full coverage.

There are some conditions where buying only liability insurance is not recommended. If you haven't satisfied your loan, you have to carry full coverage as part of the loan conditions. Also, if you can't afford to buy a different vehicle in the event your current vehicle is totaled, you should keep full coverage in place.

Components of Your Ford Explorer Sport Trac Insurance Prices

Many factors are part of the equation when pricing auto insurance. A few of the factors are predictable such as your driving record, although some other factors are more transparent such as your credit history and annual miles driven.

Buy a safe car and pay less - Vehicles with good safety scores cost less to insure. Safe vehicles have better occupant injury protection and fewer injuries means less money paid by your insurance company and cheaper rates on your policy. If your Ford Explorer Sport Trac has at least four stars on Safercar.gov or an "acceptable" rating on iihs.org it is probably cheaper to insure.

The type of vehicle makes a difference - The type of vehicle you need insurance for makes a significant difference in your auto insurance rates. The lowest base rates are generally reserved for low performance passenger vehicles, but the cost you end up paying is determined by many additional factors.

The following chart is based on a single male driver age 30, full coverage with $1000 deductibles, and no discounts or violations. The chart compares Ford Explorer Sport Trac rates compared to other models of vehicles that have a range of performance risks.

Never let your insurance expire - Driving with no insurance can get your license suspended and you will pay a penalty because you let your insurance expire. Not only will rates go up, not being able to provide proof of insurance could earn you fines or a revoked license.

Can a thief steal your car? - Choosing to buy a car that has an advanced theft prevention system can help bring down rates. Anti-theft devices like vehicle immobilizer systems, OnStar, and tracking devices like LoJack can thwart your car from being stolen.

Your address can impact price - Being located in areas with lower population may provide you with better prices when shopping for auto insurance. Less people translates into fewer accidents in addition to fewer liability claims. Drivers who live in large California cities regularly have more road rage incidents and more severe claims. More time commuting means more chances of being involved in an auto accident.